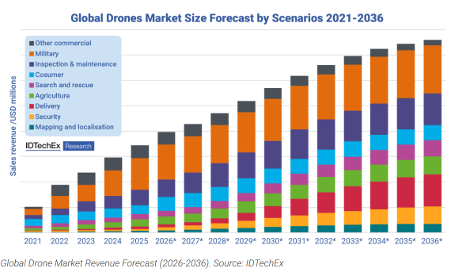

The global drone industry is entering a decisive phase. What began as experimentation is now evolving into infrastructure. According to the Drones Market 2026–2036: Technologies, Markets, and Opportunities outlook by IDTechEx, the global drone market is expected to grow from USD 69 billion in 2026 to USD 147.8 billion by 2036, representing a compound annual growth rate of 7.9%. Unit shipments are forecast to exceed 9 million drones annually by the end of this period.

This growth is not driven by consumer photography or novelty use cases. Instead, the momentum is coming from logistics, inspection, public safety, and autonomous industrial operations. By 2026, drones are no longer peripheral tools, but becoming embedded systems within supply chains, infrastructure management, and mission-critical workflows.

Over the past decade, drones have transitioned from isolated deployments into coordinated systems operating across agriculture, energy, ports, security, and healthcare. The key change is not hardware alone, but the maturation of autonomy, regulatory frameworks, and data integration.

Regulatory clarity around BVLOS (Beyond Visual Line of Sight) drone operations and the rollout of UTM and U-space frameworks are reshaping what is commercially possible. In parallel, falling hardware costs and improved reliability are lowering barriers to entry, while increasing expectations around safety, cybersecurity, and operational governance.

By 2026, the drone industry is defined less by flight capability and more by how well operations scale.

Drone logistics is one of the clearest indicators of this shift. After years of pilot projects, the sector is now moving decisively toward regional, route-dense commercial networks. According to industry forecasts, commercial drone shipments are expected to exceed 9 million units annually by 2036, with logistics and delivery representing one of the fastest-growing segments. In the US alone, operators are already conducting thousands of BVLOS drone delivery flights per day in active commercial service, signaling that scale is no longer theoretical.

Growth is visible across last-mile e-commerce, medical deliveries, offshore and island supply routes, and internal industrial logistics, particularly in North America, Europe, and parts of Asia-Pacific. Medical logistics has proven especially compelling: studies from early deployments show delivery time reductions of 50-70% compared to road transport in time-critical routes, with measurable improvements in service reliability.

What is changing is not only volume, but structure. Drone deliveries are increasingly embedded into enterprise logistics systems, connecting directly with ERP platforms, warehouse management systems, and automated scheduling tools. This integration enables predictable, repeatable operations rather than ad-hoc flights, a prerequisite for scaling beyond isolated use cases.

At the same time, advances in automated loading, cold-chain drone logistics, and hybrid VTOL cargo platforms are expanding viable operations in challenging environments such as ports, remote industrial sites, and islands. Market analysts expect that by 2026, cost per delivery will approach parity with traditional transport in specific scenarios, particularly where congestion, distance, or limited ground access dominate total logistics cost.

Inspection and maintenance is now the fastest-growing commercial drone segment. Infrastructure operators are replacing manual inspections of wind turbines, power lines, pipelines, and port assets with automated, sensor-rich drone workflows. Industry experts project that inspection and maintenance will account for more than 25% of all commercial drone revenue by 2030, overtaking agriculture.

This growth reflects both economic and safety imperatives. Manual inspections are slow, costly, and risky. Drone-based inspections, by contrast, enable repeatable data capture, reduced downtime, and continuous asset monitoring. By 2026, these workflows are increasingly fully automated, supported by drone-in-a-box systems, remote fleet supervision, and structured data pipelines.

The implication for operators and investors is clear: value is shifting from flight execution to operational orchestration and data exploitation.

Another defining trend for 2026 is the rise of autonomous, AI-assisted operations. As drone fleets scale, human-centric control models increasingly become a bottleneck. Industry benchmarks already show that manual one-pilot-to-one-drone models account for up to 60-70% of total operating costs in commercial drone programs, making them economically unsustainable at scale. As a result, the industry is shifting toward one-to-many supervision models, where a single operator oversees multiple concurrent missions instead of manually piloting individual flights.

AI plays a practical, supporting role in this transition. Predictive maintenance systems have been shown to reduce unplanned downtime by 20-30% in asset-intensive operations, while automated anomaly detection significantly improves consistency in inspection results compared to manual image review. Automated mission validation and rule-based checks also shorten pre-flight approval cycles from minutes to seconds in environments where digital authorization frameworks are in place.

However, the true enabler is not intelligence alone, but structured automation. Market research consistently shows that organizations extracting the highest value from drone deployments are those that automate workflows end-to-end, including approvals, scheduling, logging, supervision, and reporting. Without standardized operational processes, even advanced AI tools remain underutilized and difficult to audit.

This is particularly relevant in logistics and inspection, where repeatability, compliance, and traceability are as critical as speed. As regulatory scrutiny increases and operations move toward routine BVLOS drone flights, the ability to demonstrate consistent procedures and reliable oversight becomes a competitive necessity rather than a technical preference.

From an investment perspective, 2026 marks a shift from speculative platforms to operational ecosystems. Capital is flowing toward companies that solve coordination challenges: fleet management, traffic management, cybersecurity, and integration with existing enterprise systems.

The competitive landscape now includes both drone-native players and incumbents in logistics, infrastructure, and industrial automation investing heavily in drone capabilities. Consolidation is expected to continue, particularly in regions where regulatory progress enables scale.

Importantly, investors are increasingly differentiating between technology readiness and operational readiness. Companies that can demonstrate secure, compliant, multi-site operations are better positioned than those focused solely on aircraft performance.

By 2026, drones are no longer evaluated as standalone assets. They are assessed as part of integrated operational systems. Sensor proliferation underscores this shift: the statistics forecast that industrial drones will carry 10 to 15 sensors per platform by 2036, while sensor shipments grow nearly twice as fast as drone shipments themselves. This makes manual post-processing unviable.

As the drone market moves into its next phase, the distinction between flying drones and operating drone systems at scale becomes decisive. This is exactly where HHLA Sky positions itself within the evolving drone ecosystem.

The trends identified by experts (autonomous BVLOS drone operations, logistics at scale, inspection-driven revenue growth, sensor proliferation, and tighter regulatory frameworks) all point toward a single operational challenge: coordination. When dozens or hundreds of missions run simultaneously across logistics, inspection, and public safety use cases, the limiting factor is no longer the aircraft. It is the ability to plan, authorize, supervise, secure, and document operations across sites and airspace in a structured way.

HHLA Sky addresses this challenge through the Integrated Control Center (ICC) integrated with UTM solutions, which are designed to treat drones and mobile robots as operational infrastructure rather than isolated tools. Instead of managing flights one by one, organizations can orchestrate 100+ simultaneous BVLOS drone operations, combining mission planning, scheduling, supervision, and data handling into a single operational framework.

This approach directly reflects where the market is heading in 2026. As inspection and maintenance surpass agriculture in commercial drone revenue, and logistics networks shift from pilots to regional deployment, operators need systems that integrate seamlessly with existing enterprise environments. HHLA Sky’s platforms are built to connect drone operations with ERP, logistics, and asset management systems, enabling drones to function as part of broader industrial workflows.

Sensor proliferation further reinforces this model. As industrial drones carry increasing numbers of visual, thermal, multispectral, LiDAR, and radar sensors, value shifts from data collection to data governance and usability. HHLA Sky’s solutions ensure that mission data is automatically logged, structured, and available for downstream analysis, compliance, and decision-making. Without this level of automation, insight simply does not scale.

In parallel, regulatory maturity around BVLOS drone operations and U-space elevates the importance of secure, auditable operations. HHLA Sky’s UTM capabilities support automated authorization, real-time situational awareness, and coordinated airspace usage, aligning with the risk-based regulatory frameworks emerging across Europe and globally. As regulators increasingly view UTM as critical digital infrastructure, this kind of operational backbone becomes essential for safe and repeatable deployment.

Taken together, the 2026 drone market trends highlight a shift, where drones are becoming embedded into logistics, inspection, and public safety systems. HHLA Sky’s role in this transition is to enable industrial-grade orchestration, turning autonomous aircraft, sensors, and robots into reliable operational networks.

In a market forecast to reach nearly USD 148 billion by 2036, the winners will not be defined by who flies first, but by who can scale safely, securely, and efficiently. This is where HHLA Sky’s approach aligns directly with the future of the drone industry.

Source: https://www.idtechex.com/en/research-report/drones-market/1142